How Oklahoma Property Taxes Are Calculated and Who/What Really Owns Your Property

The most important hour and half you will ever spend is the hour and a half I spent talking to former McClain County Auditor turned Oklahoma Senator, Kendal Sacchieri, about how property taxes are calculated and who really owns your property. You really should take the time to watch the whole live episode of the ROPE Report from yesterday, January 15th (2025). You can find it here on YouTube and on Rumble.

As a citizen of Oklahoma, I absolutely DESPISE the fact that if I don’t pay my property taxes, the county will take my home away from me, sell it and pay whatever taxes I owe. Seriously. I may have a title to my house, but it won’t matter one whit if I don’t make good on my tax bill every year.

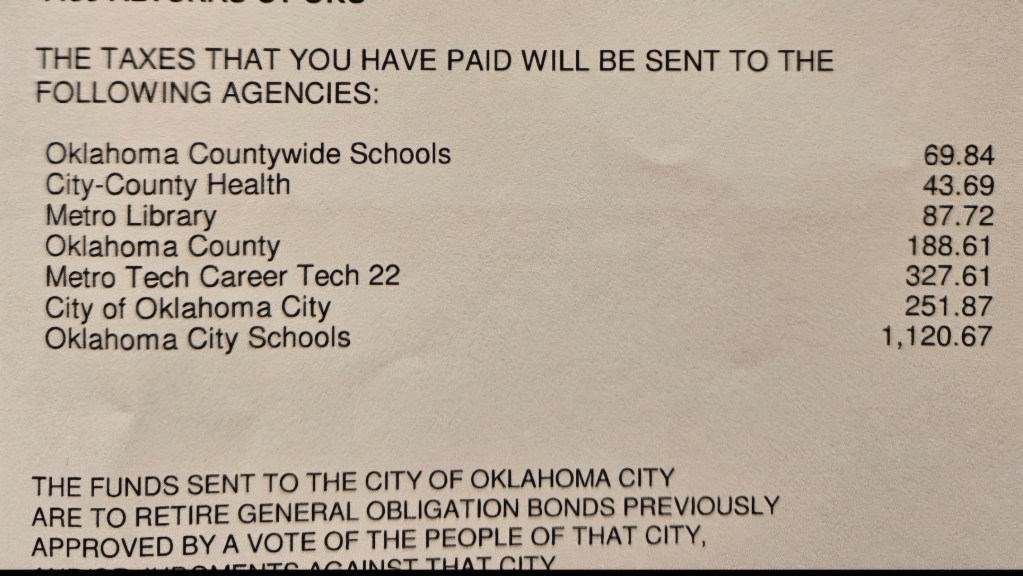

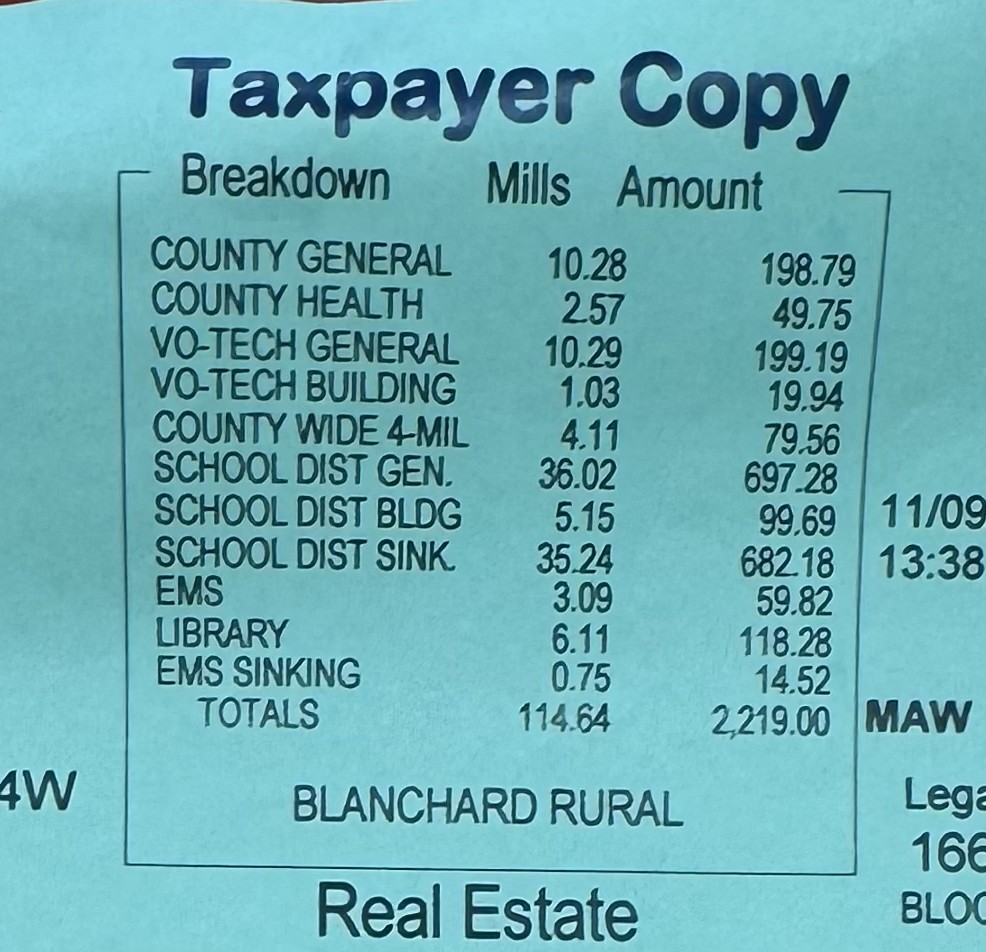

Below is the breakdown on the property taxes for a home in northwest Oklahoma City, done by the Oklahoma County Assessor. The property tax bill below that is from the McClain County Assessor’s office. Kendal told me that if your property tax bill doesn’t look like the blue one, you should ask your county Treasurer to break down the county property taxes into mills so that homeowners can better see the distribution of their tax dollars..

Note which entity is FAR AND AWAY the largest tax? Now let me ask two questions; 1. Do you feel your property taxes are too high? and 2. Have you voted on YES on a school bond?

Keep these things in mind when you watch the video below.

Now, watch this video clip. Trust me when I say it will be THE MOST IMPORTANT 7 MINUTE VIDEO OF YOUR LIFE AS AN OKLAHOMA HOME OWNER.

If you’re not throwing things at your video screen and freaking out a bit after watching those clips, we can’t be friends.

Basically, what Senator Sacchieri said was, that you don’t own your own property because of a scam that allows public schools to get more and more and more money every year NO MATTER THEIR OUTCOMES. Can’t teach kids how to read? Get more money. Can’t teach kids how to write a paragraph that makes sense? Get more money? Can’t teach kids to count back change or figure the percentage of something? Get more money. THAT IS NUTS.

Unfortunately, we, as citizens simply haven’t understood the process of property taxation well enough to stop it in the past, evidently. Fortunately, we have the Senator to TEACH us the process. Now, that she’s educated us, we need to do several things.

- We need to just drive our legislators crazy asking for a bill to put a state question on a general election ballot to remove the language from the state Constitution that allows counties to collect property taxes. The state has nothing to do with property taxes. Property taxes in Oklahoma are generated at the COUNTY level and go to the COUNTY entities you see in my example above. Once the language is removed, the county has no ability to FORCE property taxes.

- Toward the end of the full video, Kendal and I talk about the County Excise Boards. This is an important thing for you to know about. The Excise Board is a group of people who meet after the County Assessor has turned in home valuations and the county entities have decided how much in taxes they must recoup to make their budgets. The decide whether or not the budgets proposed by the entities are sound and reasonable and how much the entity will be allowed to tax your property. They must hold public hearings on the budgets submitted, allowing citizen comment. You can find your Excise Board meetings through your county office. Here is the list of Boards and Commissions for Oklahoma County. In Kingfisher, after a multimillion dollar lawsuit against a football coach for ‘hazing’ (physical abuse), the school added the lawsuit burden to their budget, expecting the taxpayers to foot the bill. The Kingfisher Excise Board members rejected the budget, forcing Kingfisher to cut their budget to pay the lawsuit. This was HUGE. This kind of thing almost never happens, but then I would imagine there are few – if any citizens – that would go to a meeting to protest a budget that would increase their property taxes. Learn about your Excise Board.

- Your School Board is VERY IMPORTANT. Go to these meetings. If your school proposes a school bond – PROTEST. They MUST have open meetings and they MUST allow citizen comments. If they won’t, band together and send out literature to the district warning residents of what a vote on the bond can do to their property tax rates. As my neighbors and I found out, it was much cheaper to band together to stop a school bond by creating a flier and splitting postage and copying costs and sending it out to district voters, than it was to have our property rates jacked up.

BOTTOM LINE: Citizens have the ability to stop property tax increases through the means above. We also have the ability to have our lawmakers act on our behalf by proposing legislation for a state question to remove the ability for counties to collect property tax. If we do neither, we simply can’t complain.

PASS THIS INFORMATION ON TO FRIENDS, FAMILY and NEIGHBORS!

Everyone needs to know this information!

[…] How Oklahoma Property Taxes Are Calculated and Who/What Really Owns Your Property […]